Camps & Conference Accident Medical Insurance

Conference Accident Medical Insurance

Camps

By: Allen Financial Insurance Group

Contact us for a no obligation Camps & Conference Accident Medical insurance quote today

♦ Sports Camps

♦ Corporate Groups

♦ Conferences

♦ Day Camps

♦ Riding Clubs

♦ Employee Groups

♦ Church Groups

♦ Fraternal Organizations

♦ Retreats

♦ School Groups

Conference Accident Medical Insurance

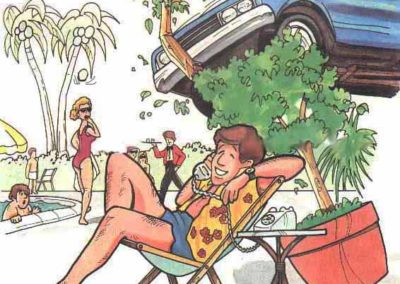

In today’s fast-paced society, accidents can happen anytime, anywhere…..while traveling with a business group, vacationing, attending school, participating in athletics or a variety of other situations. Many families have little or no medical insurance, and those who do have coverage may be required to meet large deductibles before their insurance pays any benefits.

However, now a comprehensive program has been developed to specifically cover the inherent risks involved for today’s adult groups. This Camps & Conference Accident Medical Insurance Program is designed to help eliminate the financial and emotional burden one can incur as a result of injury in today’s adult group activities.

The Accident Medical Coverage

Pays the medical bills of an injured participant or staff member

Who is Covered?

All members of the Policy Holder.

Covered Activity

All activities sponsored and supervised by the Policyholder during the Camp or Conference specified in the application, including travel with a group in connection with such activities and travel directly and without delay to or from the Insured person’s home or residence and the site of such activities.

Medical Expense Benefit

If the Insured Person incurs eligible expenses as the result of a covered injury, directly and independently of all other causes, the Company will pay the charges incurred for such expense within 1 year,beginning on the date of accident. Payment will be made for eligible expenses in excess of the applicable Deductible Amount, not to exceed the Maximum Medical Benefit.The first such expense must be incurred within 60 days after the date of the accident.

“Eligible expense” means charges for the following necessary treatment and service, not to exceed

the usual and customary charges in the area where provided”

♦ Medical and Surgical care by a Physician

♦ Radiology (X-Ray)

♦ Prescriptive drugs and medicines

♦ Hospital Care and Services in semi-private accommodations or as an outpatient

♦ Ambulance service from the scene of the accident to the nearest hospital

♦ Orthopedic appliances necessary to promote healing.

♦ Dental Treatment of sound natural teeth

This Plan does not cover treatment or service for which benefits are payable or service is available under any other insurance or medical service plan available to the Insured Person.

Accidental Death and Dismemberment Benefit

If a covered injury results in any of the losses specified below within 1 year (not applicable in Pennsylvania) after the date of the accident, the Company will pay the applicable amount:

-

Full principal sum for loss of life

-

Full principal sum for dismemberment

-

Full principal sum for loss of sight of both eyes

-

50% Full principal sum for loss of one hand, one foot or sight of one eye

-

25% of the Principal sum for loss of index finger and thumb of same hand

“ Member ”means hand, foot, or eye. Loss of hand or foot means complete severance above the wrist or

ankle joint. Loss of eye means the total, permanent loss of sight. If the Principal Sum is payable, no

indemnity will be paid for dismemberment. In any event, the Double Dismemberment Indemnity is the

maximum amount payable under this Benefit for all losses resulting from one accident

Exclusions and Limitations

this applies only while sane);

♦ Voluntary self-administration of any drug or chemical substance not prescribed by, and taken according to the directions of the Insured Person’s Physician.

♦ Participation in a riot or insurrection;

♦ An act of declared or undeclared war;

♦ Active duty service in any Armed Forces of any country, and, in such event, the pro-rata unearned

premium will be returned upon proof of service. This does not include Reserve or National Guard

active duty or training unless it extends beyond 31 days;

♦ Parachuting, except for self preservation;

♦ Bungee jumping, flight in an ultra-light aircraft, hang gliding;

♦ Sickness, disease, bodily or mental infirmity or medical or surgical treatment thereof, bacterial infection, regardless of how contracted. This does not exclude bacterial infection that is the natural and foreseeable result of an Injury or accidental food poisoning;

♦ Services or treatment rendered by a (n) Physician, Nurse or any other person who is:

– employed or retained by the Policyholder; or

– is the Insured Person or an Immediate Family Member;

♦ Flight in an Aircraft, except as a fare-paying passenger;

♦ Dental treatment, except as otherwise provided, and only when Injury occurs to sound natural teeth:

♦ Any loss for which benefits are paid under state or federal worker’s compensation, employers liability, or occupational disease law;

♦ Treatment in any Veteran Administration or Federal Hospital, except if there is a legal obligation to pay

♦ Cosmetic surgery, except for reconstructive surgery due to a covered injury;

♦ Charges which the Insured Person would not have to pay if He did not have insurance;

♦ Eyeglasses, contact lenses, hearing aids;

♦ Charges which are in excess of Usual, Customary and Reasonable charges.