Business Owner’s Policy (BOP) – BOP Insurance

(BOP) Business Owner’s Policy & BOP Insurance

By: Allen Financial Insurance Group

Contact us for a no obligation BOP insurance quote today!

What a Business Owner’s Policy Is All About:

As a business owner, you’re subject to a lot of liability. So why risk it? Protect yourself with a Business Owners Policy, or BOP, a simple and convenient way to ensure your business’s physical and financial assets are covered.

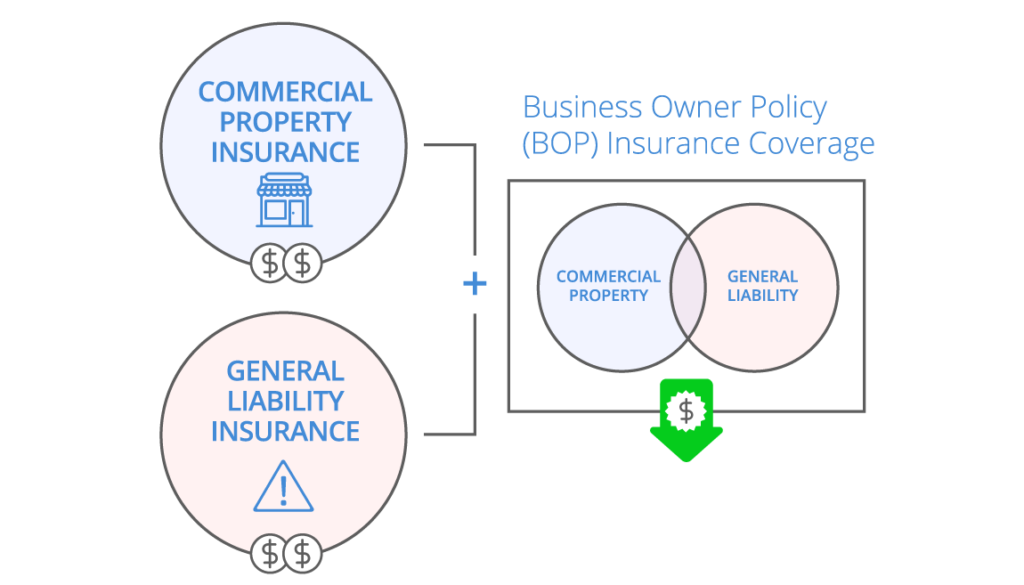

Business owners insurance, also known as BOP insurance, is a policy that combines both property and liability coverage into one package. It’s popular among a variety of small and medium-sized businesses such as restaurants, wholesalers, retail stores and contractors. A Business Owners Policy combines protection for all major property and liability risks in one convenient package. These packages are typically designed for small and mid-sized businesses, and offer a broad range of coverage.

In today’s highly competitive business environment need every advantage to succeed. That’s especially true when it comes to selecting your business insurance. Read on to learn more and see if your business should consider purchasing a BOP.

What Is a Business Owners Policy?

A Business Owners Policy packages together several policies to offer small and mid-sized business owners one convenient policy to protect themselves. It simplifies coverage needs by combining two policies that most businesses need – property and liability – while offering savings over purchasing each policy separately. Business Interruption Insurance is also frequently included in a BOP.

Businesses can tailor a BOP to meet the unique needs of their industry or situation by adding additional optional coverages. One of the most popular optional coverages to add to a BOP is data breach coverage. If your business stores or handles private customer information, you can add coverage to protect yourself in case of a data breach.

BREAKING DOWN ‘Business Owner Policy (BOP)

Specific coverage included in our BOP Insurance policy, A typical BOP policy includes…

- Commercial Property Insurance: AFIG property insurance can help protect the property your business owns, leases or rents, including things like buildings, equipment, inventory, furniture and fixtures. It provides coverage for loss of accounts receivable and valuable papers and records. Our BOP Insurance will also cover any business-owned items or items owned by a third party but kept temporarily in the care, custody or control of the business or business owner. Business property must usually be stored or kept in qualifying proximity of business premises (such as within 100 feet of the premises).

- Business Interruption Insurance: If unexpected events cause a suspension in your operations AFIG’s BOP insurance policy

covers the loss of income resulting from a fire or other catastrophe that disrupts the operation of the business. It can also include the extra expense of operating out of a temporary location. - General Liability Protection: Our Business Owner’s Policy covers the insured’s legal responsibility for damages it may inflict on others. When it comes to liability protection, the broader the coverage the better. That’s why The AFIG’s BOP Insurance policy provides business liability insurance that helps cover your business in the event it is sued for causing harm to a person and/or damage to property. It also helps cover the cost of your defense – because businesses can be sued even if they did nothing wrong.

What’s the Advantage of a Business Owner’s Policy?

It’s an even smarter and more convenient choice because other important coverages can be added to it. Businesses with specific needs can tailor their business owner’s policy (BOP) by adding additional coverages like business income for off-premises utility services, data breach and more, to suit the particular needs of their company.

Who Needs a Business Owner’s Policy?

- Your business has a physical location, whether it’s out of your home or a rented or owned office, store or other work place.

- There’s a possibility of you being sued – for example, by a customer who was injured at your work place.

- You have assets that could be stolen or damaged – whether they’re digital assets, customer data, equipment, furniture, cash or inventory.

- You need general liability insurance coverage.

What Business Owners Policy (BOP) does NOT Cover

To get professional services you can choose to buy a professional liability insurance policy in addition to Business Owners Policy.

- Certain claims, including those arising from professional services you perform.

- Client damages if you provide inaccurate or incomplete advice to a client.

BOP Coverage

A business owners policy contains two primary coverages:

Liability

The liability coverage’s available on a BOP are the same as those on a general liability policy. This includes protection against liabilities like customer injury and property damage, advertising injury, and product related claims.

A BOP doesn’t cover your employees. You’ll need a separate workers’ compensation policy.

Property

Provides coverage for commercial buildings and the movable property owned by and used for the business – referred to as business personal property. It can also pay for other things like debris removal, loss of income and pollution cleanup as part of a covered loss.

A BOP policy, like most other policies, has certain coverage exclusions that you should be aware of. If you need protection for something that isn’t covered, policy endorsements might be available to extend coverage.

For example, damage from earthquakes is typically excluded from a BOP. If you live in an area that’s prone to earthquakes, you might want to consider adding an endorsement to your policy to extend coverage. Ask about endorsement options when getting your quote.

Business Owners Policy (BOP) FAQs

Start protecting your business today!

Our team of in-house specialists are experts at helping small business owners, like you, find BOP insurance coverage. They’ll help you get a quote with the best coverage for your specific business and budget.