Farm and Ranch Insurance – Estate Insurance

Farm and Ranch Insurance

Estate Insurance & Farm Insurance

By: Allen Financial Insurance Group

Contact us for a no obligation estate insurance or Farm and Ranch Insurance quote today!

Operating a farm and ranch involves a wide variety of risks and no two are farms exactly alike. It’s essential that your farm, ranch or estate property be protected with an insurance policy specifically designed for your operations. It is equally important that the insurance company has a strong financial background and extensive agribusiness experience.

The AFIG Agribusiness Farm and Ranch Insurance & Estate Insurance Policy offers some of the industry’s broadest and most comprehensive coverage available to the farm owner at a competitive preferred price. Coverage is custom designed to meet the specific needs of your operation, from a small acreage pleasure farm to a multiple location commercial farm.

American Reliable Agribusiness Insurance draws upon more than 75 years of experience protecting American farms and ranches to offer a wide range of coverage to meet the specialized needs of your business. From small hobby farms to industrial agricultural operations, Allianz insures the evolving needs of modern-day agriculture business owners.

You obviously expect a farm or ranch policy to cover the basics; your home, agricultural buildings and farm personal property. You also require protection in the event of bodily injury and property damage that may arise from unique business or personal activities.

Chubb has the flexibility to customize an insurance program to specifically fit the customer’s needs. The Chubb Agribusiness insurance portfolio is based upon a solid tradition of premier customer service, financial stability and prompt, accurate claims adjustment.

Farm and Ranch Insurance – Estate Insurance Policy

Farm and Ranch Insurance Policy Highlights

- Eligibility – Individuals. partnerships, corporations, limited-liability corporation (LLC) owner or tenant operator.

- Format – A Multi-line policy able to include Dwelling, Outbuildings, Personal Property, Farm Equipment, Farm Personal Property, Farm & Stable Liability, Automobile, Livestock care custody control, Watercraft, and Umbrella in one package.

- Deductibles – $250 to $25,000

- Liability Limits to $25,000,000

- Property Limits to $75,000,000

Allen Financial Insurance Group has been servicing farm and ranch insurance clients for over thirty years. In the event of a loss, our clients are secure in the knowledge that their claim will be processed by our in-house claims staff specially trained to handle equine losses.

AFIG Agribusiness Farm and Ranch Insurance policies offers some of the industry’s broadest and most comprehensive coverage available to the ranch and farm owner at a competitive preferred price. Coverage can be custom designed to meet the specific needs of your operation, from a small acreage pleasure farm to a multiple location commercial farm.

Preferred Markets

- Family Farms and Ranches

- Large commercial growers and packers of agricultural products

- Cattle Ranches & Feedlots

- Grain and Row Crop growers

- Horse Farms incl Care Custody Control

- Cotton growers

- Citrus growers

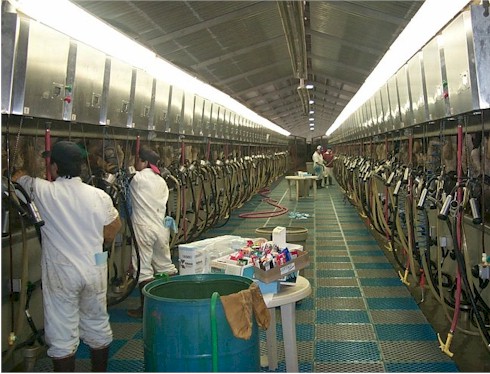

- Dairy Farms

- Hobby Farms

- Estate Farms

- Nut Orchards & Berry Growers

- Vegetable Growers & Packers

- Vineyards

- Wholesale nurseries

- Wineries

Specialty Markets

- Cotton Gins

- Dairy Operations

- Farm Products

- Farm Supply Stores

- Feed Manufacturing

- Feed Lots

- Feed, Hay and Grain Dealers

- Fertilizer Dealers & Blenders incl Application

- Flour Milling

- Food Processing

- Fish Processing & Farms

- Fish or Seafood Processing

- Elevators & Grain Handling Facilities

- Grain Milling

- Produce Packing

- Seed Merchant

COVERAGE A-- DWELLING

| Replacement Cost Primary dwelling and structures attached to covered dwellings when insured to 80% or more of replacement cost value. |

|

| Inflation Guard Optional on dwelling (including ordinance and law option) |

|

| Satellite Dish/Antenna $1,500 Limit – Higher limit available |

|

| Trees, shrubs and plants within 500 feet of covered dwelling for up to $2,000. |

Homeowner vs Farmowner Coverage Differences Explained

COVERAGE B -- OTHER PRIVATE STRUCTURES

| Limit 20% of dwelling limit for unattached structures appurtenant to the dwelling not used for farming purposes. No distance limitation. Higher limits available for charge. |

COVERAGE C -- HOUSEHOLD PERSONAL PROPERTY

| Limit 50% of dwelling limit is standard. Higher limits available. |

|

| Property off premises $1,000 worldwide |

|

| Special Limits $2,000 for grave markers $3,000 for securities and letters of credit $3,000 for furs, jewelry, precious stones and watches $5,000 for firearms $ 400 money, gold, platinum, silverware $3,000 for watercraft, outboard engines, watercraft furnishings and trailers $5,000 business property on premises, 10% off premises $5,000 for silverware or goldware. |

|

| Replacement Cost For nominal charge, Coverage C Limit automatically increased to 70% of dwelling limit. |

|

| Refrigerated Products $500 for refrigerated household contents. No deductible |

|

| Credit Card $500 for credit card and fund transfer card forgery and counterfeit money. |

COVERAGE D -- ADDITIONAL LIVING EXPENSES

| Coverage for necessary increases in living expense if a covered cause of loss renders your home uninhabitable. 10% of dwelling limit |

COVERAGE E — SCHEDULED FARM PERSONAL PROPERTY

| Newly Acquired Or Replacement Farm Machinery: $100,000 for up to 30 days |

|

| Personal Property of Other: $2,500 |

|

| Tack & Related Equipment: No sub-limit for unscheduled items |

|

| Replacement Cost : Available for office contents and tack |

|

| Transportation: $2,000 included |

|

| Farm Records: $2.000 for restoration. No deductible |

|

| Extra Expense: $2,000 included. No deductible |

|

| Livestock: Up to $2,000 per animal available |

|

| Peak Season: Available for seasonal fluctuations |

COVERAGE F — BLANKET OR UNSCHEDULED PERSONAL PROPERTY

| Unscheduled farm machinery and equipment | |

| Farm products in the open for certain causes of loss | |

| Property in the custody of a common contract carrier $1,000 Limit |

|

| Cost of restoring farm records $2,000 Limit |

COVERAGE G — OTHER FARM STRUCTURES

| Replacement Cost: Available when insured to 80% of Replacement Cost. If not insured to 80%, Actual Cash Value applies. |

|

| New Construction: Automatic $250,000 coverage for 60 days. |

|

| Private Power and Light Poles | |

| Outdoor Radio & TV equipment, antennas and towers | |

| Fences, corrals, pens, chutes and feed racks | |

| Silos, portable buildings and structures | |

| Improvements and betterments | |

| Loss of Income: Available for covered perils |

|

| Blanket Coverage: Available for farm buildings other than dwellings |

OPTIONAL COVERAGE

| Disruption of Farming Operations | |

| Earthquake | |

| Equine Professional Services Endorsement | |

| Identity Theft Protection | |

| Farm Computer Coverage | |

| High Value Dwelling Endorsement | |

| Trainers Professional Liability | |

| Livestock Breeders Endorsement | |

| Livestock Collision Endorsement | |

| Beekeepers Endorsement | |

| Watercraft Hull Coverage | |

| Agricultural machinery rental reimbursement | |

| Extra Expense and Business Income Coverage | |

| Transportation Coverage increased limits | |

| Enhanced Pollutant Cleanup Endorsement | |

| Sump overflow and water backup from sewers and drains |

Orchard & Vineyard Endorsement

|

|

|

Dairy Endorsement

|

|

|

Equine Property Endorsement

|

|

|

Tack Equipment Endorsement

|

|

|

High Value Dwelling Endorsement

|

|

|

COMPREHENSIVE PERSONAL & COMMERCIAL GENERAL LIABILITY

Limits

| Occurrence | $300,000 – $1,000,000 |

| General Aggregate | $600,000 – $2,000,000 |

| Aggregate Products/Completed Operations | $600,000 – $2,000,000 |

| Personal / Advertising Injury | $300,000 – $ 1,000,000 |

| Chemical Drift Aggregate | $25,000 – $500,000 |

| Medical | $5,000 |

| Fire Legal Liability | $100,000 |

| Excess Umbrella Liability | $5,000,000 |

Coverage Options

| Newly acquired or leased premises: Automatically covered during policy term. Must be added at renewal to be covered. |

|

| Broad Form Contractual: Included |

|

| Custom Farming: Included when receipts less than $10,000 |

|

| Pollutant Cleanup $10,000 including debris removal (can be increased) |

|

| Automobile: Optional |

|

| Personal Injury: False arrest, slander, wrongful entry and eviction covered |

|

| Advertising: Included |

|

| Incidental Business Pursuits: Available subject to underwriting guidelines for charge |

|

| Catastrophe Liability: Excess liability available with limits $1,000,000 to $25,000,000 |

|

| Care, Custody & Control Optional coverage for horse of others under your control with limits $5,000 to $250,000 |

INELIGIBLE RISKS

| Farms principally engaged in commercial operations other than farming or ranching | |

| Dude Ranches, religious retreats | |

| Vacant farms or ranches | |

| Nursery operations – Retail | |

| Poultry hatcheries |