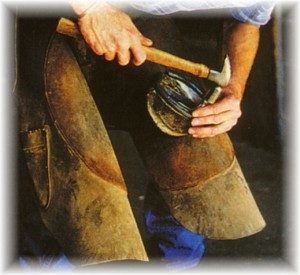

Farrier Insurance – Farrier Liability Insurance

Farrier Insurance & Farrier Liability Insurance – $300 minimum premium

By: Allen Financial Insurance Group

The AFIG Farrier Insurance Program and Farrier Liability Insurance policy is designed to respond to the specific needs of a professional farrier. Legal cases and lawsuits are more prevalent as technology, and information increases to identify the cause of laminitis, lameness, improper hoof angles and/or using pads improperly, more horse owners are likely to point the finger at the farrier when things go wrong. This plan gives you the ability to buy broad property and liability coverage at preferred rates. The Farrier Insurance Policy guarantees better service and more coverage for the insurance dollar than any other program.

Program Highlights

- National A rated company

- Low Preferred Rates

- AFA Association Credit

- Immediate Quotes

- Easy Payment Plans

- Immediate Certificates of Insurance

- 24 / 7 Claims Service

The Farrier Insurance Program is available

to farriers throughout the United States.

Contact us for a no obligation farrier liability insurance quote today

Get a Farrier Insurance Quote!

What kind of protection does the Farrier Insurance Program Provide?

If a person (other than an employee) is injured on your premises or as a result of your business activities, you are covered. If property is damaged because of your negligence you are also covered. You are protected for claims against products you sell or work you have performed. If a horse is injured or dies while in your care, custody and control, you are covered up to certain limits spelled out in the policy. In addition, your equipment and supplies are covered against loss or damage! Coverage is written through a domestic, A rated insurance company and tailored to fit your specific business operations and budget.

| Occurrence | $1,000,000 – $2,000,000 |

| General Aggregate | $1,000,000 – $2,000,000 |

| Aggregate Products/Operations | $1,000,000 – $2,000,000 |

| Personal Injury / Advertising Injury |

$1,000,000 |

| Medical | $5,000 |

| Damage To Premises Rented To You | $100,000 |

| Care, Custody & Control Coverage |

Coverage in this program includes:

Farrier’s Liability:

This program begins with a broad array of liability coverage vital to the operation of your business. In addition to being covered against liability risks specifically associated with the farrier activity you are also covered in such areas as product liability, property damage liability and legal services. Coverage can also be extended to independent contractors and farrier’s helpers.

Equipment & Supplies Floater:

The policy offers standard limits of $1,000, $2,500 or $5,000 with a $500 deductible per claim. This coverage provides protection for loss or damage to your transportable inventory of horse shoes, tools and supplies that are used in connection with your farrier practice. Theft is covered but please refer to the policy for specific details on other perils covered.

Care,Custody and Control Liability:

This insurance is essential for every farrier business as you are responsible for other people’s horses while working with them. The policy pays all sums you are legally obligated to pay others for damage to horses in your care, custody or control. Standard limits of $5,000, $10,000 or $25,000. This important benefit picks up coverage for injury to any non-owned horse as a result of your negligence as Farrier while the horse is in your care, custody and control.

Farriers Associations

-

- American Farrier’s Association

- American Association of Professional Farriers

- The guild of Professional Farriers

- Brotherhood of Working Farriers Association

Understanding Claims Made Insurance – Claims Made vs Occurrence Form Liability

Farriers Safety Guidelines

In a rush?

Call 800.874.9191 for an immediate quote