Horse Mortality Insurance & Horse Medical Insurance

Contact us for a no obligation equine mortality insurance quote today!

Call 800-874-9191 or get a quote on-line below

It’s important that your Horse Mortality Insurance & Major Medical Insurance policy is provided by an A rated company with a national presence, strong financial background and established equine expertise. The Equestrian Group offers this stability through it’s Equine Mortality Division.

The Equestrian Group has the most comprehensive and unique Horse Mortality Insurance – Major Medical Insurance product portfolios available for horse owners, our coverage can be stacked, making each policy customizable. A horse is a valuable asset whether owned for pleasure or professional use they require investment and care. Protecting your asset may be costly and can involve more than just feeding, housing and medical attention. If the horse causes property damage or injury, the horse owner is responsible and can be held liable for compensation, if the horse however becomes sick or dies, unexpected medical expenses may arise.

The Equestrian Group has served horse owners for over 40 years. Our knowledgeable agents, underwriters and claims staff possess the experience and training to handle all facets of your equine insurance.

All Risk Equine Mortality & Theft

This policy is available for foals, yearlings, stallions, mares and geldings of all breeds and types. We have designed this coverage to insure your horse against death from almost any cause. This includes transportation and humane destruction made necessary by an illness or accidental injury anywhere in the continental United States. Our Horse Mortality Insurance & Major Medical Insurance is unique in the industry as our Basic Form includes coverage for theft and $3,000 colic surgery including aftercare at no additional cost. We can even quote and bind coverage on the telephone!

Our policy automatically includes Free Colic Surgery coverage, providing the horse does not have a history of colic problems. The coverage limit is 60% of the insured value with a maximum of $3,000 and no deductible. If you insure your horse for Major Medical Insurance or Surgical as well, you will have access to the maximum limits on both coverage parts.

Guaranteed extension and agreed value coverage are also automatically included in full mortality policies. Veterinary exams and certificates are not required for horses under $100,000.

Guaranteed Coverage Extension

The Full Horse Mortality Insurance & Major Medical Insurance policy also includes Guaranteed Extension coverage. This coverage provides that in the event of a condition occurring and reported during the policy period, horse mortality insurance coverage will automatically continue for up to 12 months from the expiration date for that specific condition.

Major Medical & Surgical

This coverage will help you control unforeseen veterinary expenses for events related to the health of your animal. This valuable endorsement covers up to $7,500, $10,000 or $15,000 of reasonable and customary veterinary, medical and surgical care charges necessitated by accident, injury or illness. Humane destruction is covered under the policy but economic destruction is not. If you choose to put your horse down for financial reasons, the policy will not offer coverage for this. Not all policies are created equally. The adage “you get what you pay for” is very true. For example, most policies impose a time limit for how long the insurer will cover a medical problem. This limit varies between companies and can be as short as four weeks. Our policy will cover for the problem for the entire policy period in which it happened. This can be quite important if you are dealing with a serious problem like EPM where the necessary medication and care is both lengthy and costly.

- Diagnostics

- Lameness

- Continuing Care – No policy continuing care time limits.

- Navicular, arthritis, and DJD – Conditions such as navicular, arthritis, and DJD are not automatically excluded.

- Medical extensions – Policy provides for up to 30 days additional coverage after expiration. Some companies have no extension on medical conditions occurring just prior to expiration.

Full Loss of Use

Colic Medical & Surgical Coverage

Loss of Use - External Injury Only

Stallion Infertility AS&D

Trip Transit Coverage

Valuation

Binding Coverage

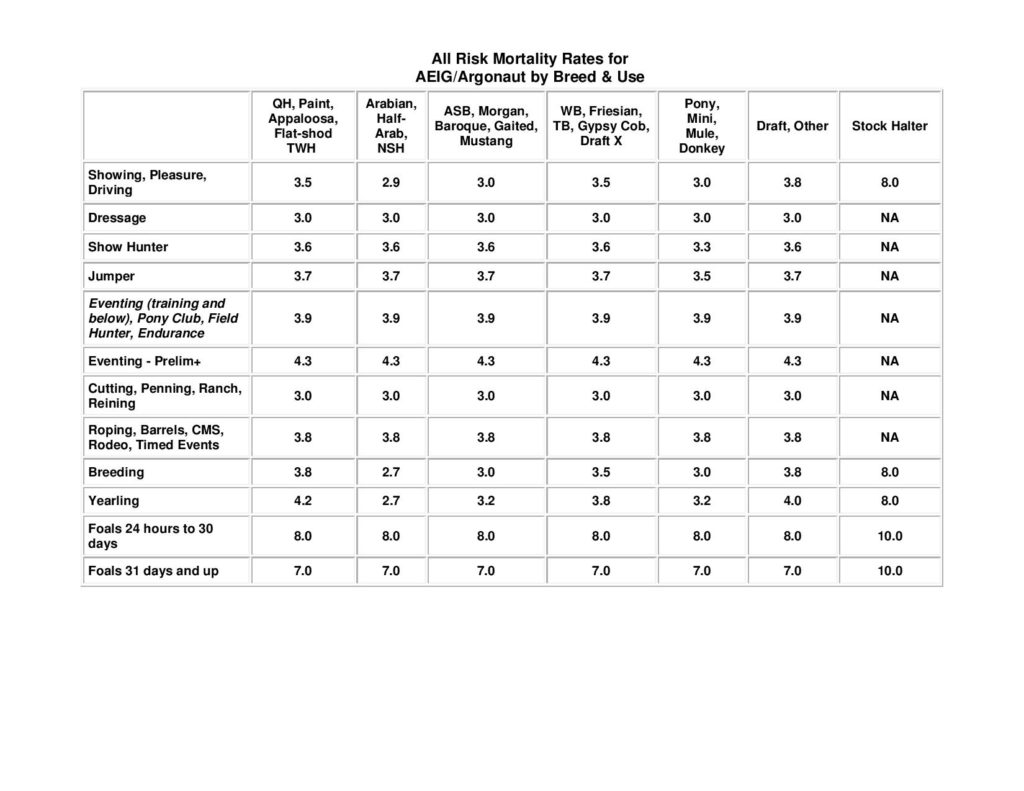

All Risk Mortality Rates by Breed & Use

Download our All Risk Equine Mortality Insurance Rates by Breed & Use (pdf chart)

click on the image above to download the.pdf

|

Mortality Policy Plans & Options |

||||

| Company Plans | HANOVER | XL | ARIC | ARGO |

| Major Medical – Limits/Deductibles |

$7,500 – $500/$1000 |

$ 7,500 – $450 |

$ 7,500 – $425 |

$ 7,500 – $400 |

|

Major Medical |

20% co-pay *Regenerative therapy limits |

40% co-pay for diagnostics *Regenerative therapy limits |

Treatment: $2,500 Diagnostics: $2,500 $4,000 Aggregate |

Treatment: $2,500 Diagnostics: $2,500 $4,000 Aggregate |

| Additional Colic Surgery Coverage | Includes $5,000 additional colic surgery with full mortality policy | Includes $5,000 additional colic surgery with full mortality policy | Includes $5,000 additional colic surgery with full mortality policy. | Includes $3,000 additional colic surgery with full mortality policy |