Federal Crop Insurance

Federal Crop Insurance

Crop Insurance Policies

By: Allen Financial Insurance Group

Contact us for a no obligation Federal Crop insurance quote today!

Federal Crop Insurance

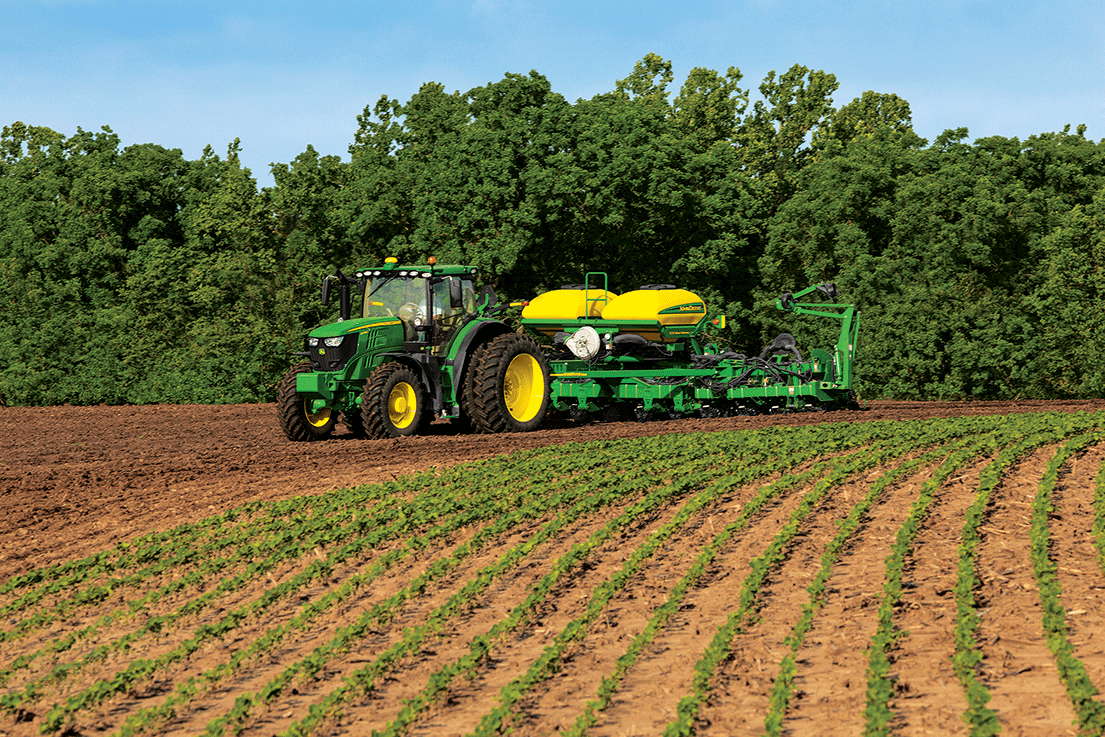

It is essential that your farm, ranch or estate be protected with a federal crop insurance policy specifically designed for your operations. It is equally important that your insurance company has a strong financial background with extensive agribusiness experience. Crop insurance currently protects $80 billion of America’s agriculture production. Crop loss indemnity payments to farmers in 2011 has exceeded $6 billion dollars.

Allen Financial Insurance Group has been serving America’s farmers and ranchers for over thirty years. In the event of a loss, our customers are secure in the knowledge that their claim will be processed by our claims staff specially trained to handle agribusiness losses.

Our Federal Crop Insurance Policy offers some of the industry’s broadest and most comprehensive coverage available to the ranch or farm owner at a competitive price.

Crop coverage can be custom designed to meet the specific needs of your operation, from a small acreage hobby farm to a multi-state commercial farm.

The Federal Crop Insurance Reform Act of 1994 dramatically restructured the program. And in 1996, the Risk Management Agency (RMA) was created in the U.S. Department of Agriculture to administer the Federal crop insurance program. Through subsidies built into the new program guidelines, participation increased dramatically. By 1998, more than 180 million acres of farmland were insured under the program, representing a three-fold increase over 1988. In 2008, more than 272 million acres are insured through the program protecting a record-setting 90 billion dollars of crop value. In May of 2000, Congress approved another important piece of legislation: the Agricultural Risk Protection Act (ARPA). The provisions of ARPA made it easier for farmers to access different types of insurance products including revenue insurance and protection based on historical yields. ARPA also increased premium subsidy levels to farmers to encourage greater participation and included provisions designed to reduce fraud, waste and abuse.

- In 2011, approximately 263 million acres of farmland were protected through the Federal Crop Insurance Program.

- There are 15 private sector insurance companies that currently sell and service policies through the Federal Crop Insurance program. Altogether, these companies issued more than 1.1 million policies in 2011.

- According to Dr. Bert Little, Tarleton State University, the rate of fraud in the Federal Crop Insurance program is estimated to be less than one-half of one percent. By insurance industry standards, this is an extremely low rate of fraud.

- More than 80 percent of insurance farmland in the United States is now protected through the Federal Crop insurance program. In 1985, that number stood at less than 18%.

1. Crop-Hail

2. Multiple Peril Crop Insurance (MPCI).

Under the Federal crop insurance program’s unique public-private partnership, there are currently 16 private companies authorized by the United States Department of Agriculture Risk Management Agency (USDA RMA) to write MPCI policies. The service delivery side of the program — writing and reinsuring the policies, marketing, adjusting and processing claims, training and record-keeping, etc. – is handled by each private company. The program is overseen and regulated by the Risk Management Agency (RMA). The RMA sets the rates that can be charged and determines which crops can be insured in different parts of the country. The private companies are obligated to sell insurance to every eligible farmer who requests it and must retain a portion of the risk on every policy.

The Federal government also subsidizes the farmer-paid premiums to reduce the cost to farmers. The Federal government also provides reimbursement to the private insurance companies to offset operating and administrative costs that would otherwise be paid by farmers as part of their premium. Through this Federal support, crop insurance remains affordable to a majority of America’s farmers and ranchers.

By combining the regulatory authority and financial support of the Federal government with the efficiencies of the private sector, the crop insurance program has succeeded in meeting and even surpassing the goals set forth by Congress for broad participation, diversity and inclusion. By using the private sector, risk is shared among the private companies as well as the government.

Federal Crop Insurance Information

Crop - Hail

Common Crop Insurance Policy - Combo Plan

Yield Protection (YP)

Revenue Protection (RP)

Revenue Protection with Harvest Price Exclusion (RPE)

Actual Production History Crop Insurance (APH)

Group Risk Protection (GRP)

Group Risk Income Protection (GRIP)

Like GRP, GRIP is based on the experience of the county rather than individual farms, so while maintaining the insured’s actual production history is encouraged, it is not required for this program. A GRIP policy includes coverage against potential loss of revenue resulting from a significant reduction in the county yield or commodity price of a specific crop. When the county yield estimates are released, the county revenues will be calculated. An indemnity is due under GRIP when the county revenue published by FCIC is less than the trigger revenue. Since this plan is based on county revenue and not individual revenue, the insured may have a loss in revenue on their farm and not receive payment under GRIP. The Harvest Revenue Option (HRO) Endorsement is available for GRIP (see below).

County Advantage Supplemental Insurance

GRIP with Harvest Revenue Option (GRIP HRO)

This information and decision tool is provided as a means to assist growers in making crop insurance and risk management decisions.

Understanding how loss payments are determined is an important part of choosing the correct crop insurance product. Actual Production History (APH), Revenue Protection (RP), Revenue Protection with Harvest Price Exclusion (RPHPE) and Yield Protection (YP) currently account for a large proportion of the protection in force. The Loss Estimation Worksheet is a loss estimator that demonstrates the differences in how losses are calculated under the APH, RP, RPHPE and YP programs.

This worksheet is strictly a simulation of loss payments based on a set of assumptions supplied by the user. Any differences in actual yield and/or price other than those selected could cause a substantial difference in performance.