Food Processing Insurance – Manufacturer Insurance

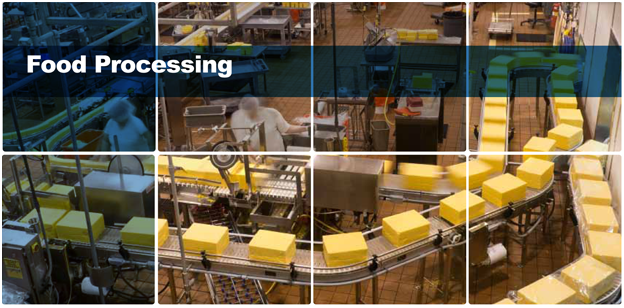

Food Processing Insurance

Manufacturer Insurance

By: Allen Financial Insurance Group

Contact us for a no obligation food processing insurance quote today

Food Processing Insurance – Manufacturer Insurance

Insurance for Your Food and Beverage Company

When you are involved in the food and beverage industry, protection for your business is one ingredient nobody can afford to leave out. Allen Financial Insurance Group has over 40 years of experience in the Food Processing Manufacturing Insurance industry. After Chipotle’s fiasco in early 2016, we know the effect a product recall can have on your customers, employees, and reputation. We have specific insurance coverage specifically designed for the unique exposures of Food Processing & Manufacturing.

Did you know that 8,061 regulated products by the FDA were recalled in 2014?1(FDA Enforcement Statistics Summary, 2014 Fiscal Year.) Equipment failure can cause injuries to employees, or food contamination that may result in product recalls, lawsuits, and fines. Disruptions like severe weather, fire, distracted driving, and equipment breakdown can impact shipping and delivery routes, potentially having a negative effect on your company’s brand, reputation and operations.

Can you benefit from this policy?

- Candy & Confectionery

- Bakery & Bakery Products

- Dairy

- Frozen Specialties

- Fruit and Vegetables

- Meat /Poultry

- Processed Foods

- Wine & Spirits

Food Processing Insurance – Manufacturer Insurance Coverage

The Business Owner’s Policy or BOP protects your business in a number of ways. It’s a policy that is important for you to know about, because the unthinkable can happen. And you want protection from financially devastating possibilities.

Property Coverage Features

- Special Form

- Replacement Cost

- No Co-Insurance

- Deductible Options: $500 to $25,000

- Building Coverage Includes:

- Completed Additions

- Fences & Fixtures

- Permanently Attached Machinery & Equipment

- Building Glass

- Retaining Walls

- Owned equipment used to maintain property

- Newly acquired or constructed buildings – $500,000 for 180 days

- Ordinance of Law – $25,000

- Outdoor Trees, Plants & Shrubs – $3,000

Business Personal Property:

- Property within 1000 feet of the premises

- Improvements & Betterments

- Sales Representatives Samples – $25,000

- Personal Property at exhibitions – $25,000

- Brands & Labels – $25,000

- Peak Season – 25% over BPP limit

- Patterns, Dies & Molds – $50,000

- Theft of gold, silver, platinum and precious metals used in manufacturing – $25,000

- Newly acquired business personal property – $250,000 for 180 days

- In Transit and at temporary locations you do not own

- Spoilage

- Temporary Relocation of Property – $50,000 for up to 90 days

- Theft damage to rented property

- Non-Owned Detached Trailers – $5,000

- Transportation of goods by common carrier or owned vehicles including spoilage available

Equipment Breakdown – Included

- $25,000 coverage for pollutant contamination

- $25,000 coverage for expediting expenses

- $100,000 limit to diagnostic, power generating or production equipment (Limit can be increased by endorsement)

Electronic Data Processing

- Included in Business Personal Property limit to $50,000 maximum (Limit can be increased by endorsement)

- Interruption of Computer Operations – $25,000 aggregate for physical loss to EDP equipment

- Worldwide Coverage

- $25,000 Transit – Off Premises

- $25,000 Newly Acquired EDP

- $25,000 Backup Data off premises

- $25,000 Electronic Vandalism

- Fine Arts up to $25,000 (Limits can be increased by endorsement)

- Signs – On premises

Business Income & Extra Expense – Actual Loss Sustained for up to 12 months.

- Deductible does not apply

- 90 day payroll limitation

- Manufacturer’s consequential loss – $25,000

- Up to 60 days extended period of indemnity

- Business Income newly acquired premises – $250,000 for 90 days

- Full ordinary payroll available

Additional Coverage Included:

- Arson & Theft Reward up to $5,000

- Claim Data Expense – Up to $5,000 for appraisal and inventory expenses

- Debris Removal – 25% of direct claim amount to maximum of $25,000

- Expediting Expenses up to $25,000

- Fire Department Service Charge to $25,000 (deductible does not apply)

- Fire Protective Equipment Discharge – $10,000 for accidental or intentional discharge

- Pollutant Cleanup and removal – $50,000 annual aggregate

- Employee Dishonesty – $10,000 (Limit can be increased by endorsement)

- Money & Securities – $10,000 (Limit can be increased by endorsement)

- Accounts Receivable – Up to $25,000 (Limit can be increased by endorsement)

- Valuable Papers – Up to $25,000 (Limit can be increased by endorsement)

Liability Coverage Includes:

- Premises & Operations

- Advertising & Personal Injury

- Blanket Contractual – Oral & Written

- Products Liability & Completed Operations

- Broad Form Property Damage

- Unlimited Defense Costs

- Host Liquor Legal Liability

- Medical Payments – $5,000

- Damage to Premises Rented to You – $300,000

- Web Extend for website liability

- Limited Worldwide Coverage

Liability Options Available:

- Aircraft chartered with crew

- Blanket Additional Insured

- Blanket Waiver of Subrogation

- Bodily Injury – Amended Definition

- Broadened Named Insured

- Incidental Medical Malpractice

- Injury to co-employees and co-volunteers

- Knowledge and notice of occurrence

- Non-Owned Watercraft increased to 50′

- Personal Injury – Assumed by Contract

- Employee Benefits Liability

- Garage keepers Legal Liability – Available by endorsement

- Hired & Non-Owned Auto – Available by endorsement

- Umbrella

WORKING TO CONTROL COSTS

With our BOP, you can reduce your premium costs by choosing a higher deductible. We offer a wide variety of deductible options, from $250 to $5,000. What’s more, we offer substantial discounts to businesses in buildings equipped with sprinklers and superior construction.

FLEXIBLE PAYMENT PLANS

You also have a choice of payment plans to make it easy on your budget. Ask us about the flexible payment options we offer.

SUPERIOR CLAIMS SERVICE

Settling a claim has never been easier. Allen Financial Insurance Group has claims offices throughout the nation to provide fast, accurate claims service. We’re among the top-rated insurers in handling claims. In fact, 96% of our customers rate our claims service as excellent.