Liquor Insurance – Liquor Liability Insurance

Liquor Liability Insurance & Liquor Insurance

$1,000,000 Liquor Premiums starting at $500.00

By: Allen Financial Insurance Group

Contact us for a no obligation liquor liability insurance quote today!

What is Liquor Liability Insurance?

At the highest level, this insurance protects a company that manufactures, sells or serves alcohol, against claims that occur when a patron drinks too much and injures himself or someone else. Liquor liability insurance, also known as dram shop insurance, is liability coverage for businesses that serve, sell, distribute, manufacture or supply alcoholic beverages.

Unfortunately, this means that if you sell alcohol or liquor on site, then you could be held liable for your patron’s actions and wrongdoings. The issue is, that alcohol can impair the judgement of the consumer and if your business is serving it, it’s important that you are prepared for what may happen next. Restaurants, clubs, taverns and bars that serve alcohol in any form, including wine, beer and spirits could end up footing the bill for damages done by an inebriated patron.

While it may seem unfair, your establishment could be sued if someone drinks at your location and then goes on to cause an accident, damage property or cause injury to themselves or others. Liquor Liability Insurance protects your business in the event of an incident; your standard insurance policy likely will not cover an alcohol-related incident.

What Liquor Liability Insurance Is All About:

There has always been a lot of confusion about the need for liquor liability insurance even among insurance professionals. Liquor Liability laws vary greatly by state and Liquor Liability coverage options are often confusing and limited. Here is some basic information dealing with the subject. The most challenging definition in the commercial general Liability policy is coverage granted for Host Liquor which is defined to cover organizations who are not “in the business” of selling alcohol.

Simply stated, liquor liability applies to businesses that sell alcoholic beverages and liquor. In most states, stores, restaurants and other businesses that provide alcoholic beverages as a service or commodity are required to carry liquor liability insurance, but there are still ways by which patrons can take legal action against the establishment from which they purchased and/or consumed alcohol.

In many cases, poor policies employed by store and restaurant owners and their employees create situations that prompt legal action by the consumer. Examples include providing liquor in venues that are do not effectively regulate mandatory age restrictions, improperly trained staff, and owners and managers who provide liquor to individuals who may prove dangerous to themselves and other patrons as a result of their intoxication level.

|

Liquor Insurance & Liquor Liability Policy Highlights |

|

| Full Occurrence Form | |

| Primary Liability Limits | $300,000 – $1,000,000 |

| General Aggregate | $300,000 – $2,000,000 |

| Defense Costs | Unlimited |

| Excess Liability Limits | $5,000,000 |

Liquor Insurance & Liquor Liability Policy Highlights:

- A+ rated insurance company

- Occurrence Basis

- Up to $6 million liability limits

- Commercial liability applies in the U.S., U.S. territories & Canada

- Employees are named as Additional Insured

- Defense cost paid in excess of policy limit

- Extended coverage for Additional Insured

- Independent contractors can be added to policy

- Special Events coverage available

- Convenient payment options

If you operate any kind of business involved in the commercial sale or distribution of alcoholic spirits you need a Commercial Liquor Liability Insurance policy. Liquor Insurance and/or Liquor Liability Insurance pays the damages for liability imposed upon you or your business by the law. It also pays the cost of defending you when a claim is made against your policy.

Liquor Liability Insurance policies are designed to help protect you if you are sued by a third party who is injured or whose property is damaged. A third party is generally someone who is not a family member or employee. The policy covers defense costs and pays claims for which you are legally liable up to the policy limits.

If you have employees you should carry workman’s compensation insurance as they are not covered under the general liability policy. You should also make sure that any independent contractors or vendors that work with you show proof of their own liability insurance and ask that you be named as an Additional Insured on their policy.

Designed to insure any type of Liquor Related Business:

- Restaurants

- Bars & Taverns

- Convenience Stores

- Special Events

- Casinos

- Sports Facilities & Complexes

- Catering Companies

- Liquor Stores

- Wineries

- Fraternal Organizations

- Distributors & Manufacturer

What are “Dram Shop” Laws?

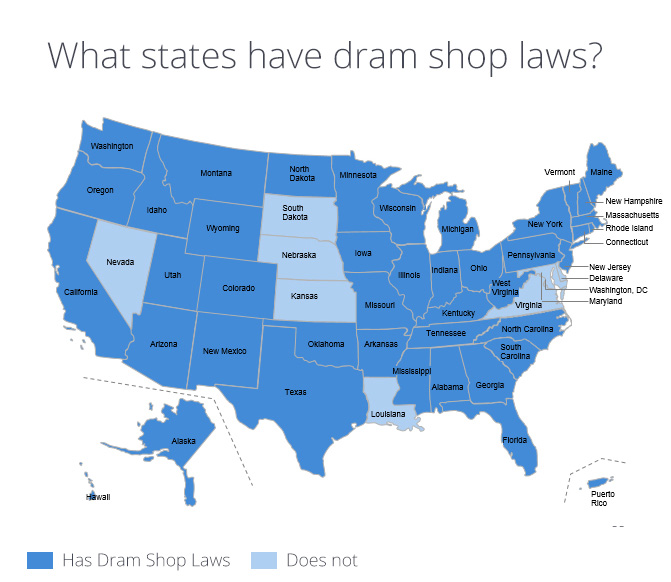

“Dram Shop” laws (a law that makes a business liable if they serve a patron who is clearly intoxicated) exist in forty-three states, and make it even easier for you to be sued after one of your over served patrons causes harm to someone else. There are several ways that your business could be harmed if you serve alcohol but do not have a Liquor Liability Insurance policy in place. If a customer leaves your bar or restaurant and then causes an accident while driving his own or someone else’s car, you could be sued for damages, even though you were not directly involved in the accident. You could also have trouble if patrons get into a physical altercation on your property or at your event after drinking on site; you could be sued by one or both parties if injuries have occurred.

Liquor Liability insurance protects your business from these types of claims and covers you even if you are sued by your inebriated customers or their victims. If you are sued and do not have liquor liability coverage, you could end up responsible for criminal and civil damages – hefty court costs and legal fees, too. A single claim could damage your reputation and ruin the business you’ve worked so hard to build. Having coverage means protecting yourself, your valuable assets, and your employees and can save you both time and money.

Liquor Insurance & Liquor Liability Insurance

- Liquor Legal Liability: Provides coverage for bodily injury or property damage for which you may become legally liable as a result of contributing to a person’s intoxication. This coverage is provided by a separate policy and will only cover insureds ” in the business of “ manufacturing, selling, distributing, serving alcoholic beverages for charge or no charge if a license is required for the activity. This exposure is not covered under the general liability policy.

Do I Need Liquor Liability Insurance?

This insurance comes in handy if your business:

- Is mandated by your state to carry this form of coverage

- Is required by your bank or financial institution to carry this form of coverage

- Serves alcohol at your hotel, B&B, café, restaurant or bar

- Serves alcohol at your business event or party

- Offers catering services that include alcoholic beverages

- Owns a facility that can be rented out for parties, events or weddings

- Runs fundraisers or special events that include alcoholic beverages on site or a bar (paid or open)

What Does Liquor Liability Cover?

This insurance covers you in the event of an accident, altercation or other event involving someone who was served alcohol at your establishment. While insurance will not prevent someone from filing a lawsuit against you, it will protect your assets if damages are awarded.

Getting Into the Details…

Every policy varies, but learning more about how this coverage works and what is covered (and what isn’t) can help you protect your business. It is important to understand both what you need from insurance and what any policy you are considering actually offers. A careful review of the policy details can help you know what to expect and what events you’ll be covered for.

| Type of Claim | Description |

|---|---|

| Drunk Driving | If a patron got drunk at your establishment and then got behind the wheel of a car, you’re at risk in the 43 states that have Dram Shop laws |

| Assault and Battery | If a patron starts an alcohol-fueled fight and someone gets injured and sues |

| Sexual Assault and Sexual Harassment | If a drunk patron sexually harasses or attacks another patron at your establishment or event |

| Slips, Falls and Personal Injuries | If an inebriated patron injures themselves inside your establishment |

You’ll Know It’s the Right Policy If It Covers:

- Assault and Battery (which sometimes occurs when a patron is being escorted from the premises)

- Property damage caused by the drunk individual

- Personal injuries caused by the drunk individual

- Your employees, who may drink on the job (even if they’re not supposed to)

- Any litigation fees and court fees related to defending your establishment from a lawsuit.

What Does Liquor Liability Insurance Not Cover?

This type of insurance is a must for many reasons – it may even be required by your state or locale – but it doesn’t cover everything that could happen on your premises. Liquor Liability Insurance generally does not cover:

- Patrons who are underage and drinking

- Offenses outside of property damage and bodily harm (slander, libel, etc. are not covered)

- Damages to your own property

Liquor Insurance Loss Control Claims Guidelines

In the event of a person becoming intoxicated on your premises, be proactive in how you handle the situation. Follow alcohol awareness training guidelines to help resolve the situation.

- Log Book. Require bartenders to keep a log book of incidents that take place.

- Make Note. Be aware of the arrival and departure time of any person who appears to be visibly intoxicated

- Document. Record any intervention attempted including refusal of service, food offered, transportation arranged, and witnesses. Obtain names and phone numbers if possible.

- Advise. Your staff should not provide information about an incident to anyone other than your attorney, law enforcement officer, or an authorized representative of your insurance company

- Save. Register receipts, payroll records, and work schedules should be kept for at least three years.

- Follow Up. Meet with your staff regularly to ensure they are properly trained and in the event of a claim, are maintaining log notes as requested.

Defense costs for lawsuits are also provided in this coverage, whether substantial or groundless. Policy payments extend to the cost of bail bonds, interest on judgments against you and expenses you incur at our request to assist in your defense.

Liquor Insurance Loss Avoidance Guidelines

To ensure your organization thrives, please consider these tips to help minimize your liquor liability exposure.

- Train. All employees should be trained in alcohol awareness with a formal training program to recognize and manage intoxicated customers

- Develop. Create a written policy about serving alcohol. Establish guidelines for staff and customers. Hold regular meetings with your staff to discuss and encourage this policy

- Licensing. Make sure you have the proper licenses and permits for the services you provide

- Closing Times. Should be no later than the prevailing closing times for your area.

- Control. The serving size of drinks should be limited. i.e. do not serve beer in cups larger than 24 oz. and encourage accurate measures of alcohol content in drinks.

- Discontinue. Drinking contests and long/late happy hours which encourage greater alcohol consumption leading to more rapid intoxication. The increased risk outweighs the increased sales.