Allianz Agribusiness – Allianz Farm Ranch Insurance

Fireman’s Fund Farm Ranch

Allianz Agribusiness | Allianz Farm Ranch Insurance | Fireman’s Fund Farm Ranch Estate

Allianz draws upon more than 135 years of experience protecting American farms and ranches to offer a wide range of coverages to meet the specialized needs of agribusiness. Your client expects a farm or ranch policy to cover the basics: the home, agriculture buildings and farm personal property. But they also require protection in the event of bodily injury and property damage that may arise from farming or personal activities.

The Allianz Global Group is one of the world’s largest multiline property and casualty insurers. With operations in 53 countries, Allianz provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients.

It’s essential that your farm ranch estate be protected with an insurance policy specifically designed for your operations. It is equally important that the insurance company has a strong financial background and extensive agribusiness experience.

The Allianz Agribusiness Farm Ranch Estate Policy offers some of the industry’s broadest and most comprehensive coverage available to the ranch or farm owner at a competitive preferred price.

Coverage can be custom designed to meet the specific needs of your operation, from a small acreage pleasure farm to a multiple location commercial farm.

Allianz Farm Ranch & Estate Insurance

Fireman’s Fund Insurance Portfolio

Allianz – Fireman’s Fund Farm Ranch

Insurance Policy Highlights

- Eligibility – Individuals. partnerships, corporations, limited-liability corporation (LLC) owner or tenant operator.

- Format – A Multi-line policy able to include Dwelling, Outbuildings, Personal Property, Farm Equipment, Farm Personal Property, Farm & Stable Liability, Automobile, Livestock care custody control, Watercraft, and Umbrella in one package.

- Deductibles – $250 to $25,000

- Fire Department Service – No limit, no deductible

Allen Financial Insurance Group has been servicing farm and ranch clients for over thirty years. In the event of a loss, our clients are secure in the knowledge that their claim will be processed by our in-house claims staff specially trained to handle equine losses.

The Allianz Farm Ranch Insurance Policy offers some of the industry’s broadest and most comprehensive coverage available to the ranch or farm owner at a competitive preferred price. Coverage can be custom designed to meet the specific needs of your operation, from a small acreage pleasure farm to a multiple location commercial farm.

Allianz Preferred Markets

- Family Farms and Ranches

- Large commercial growers and packers of agricultural products

- Cattle Ranches & Feedlots

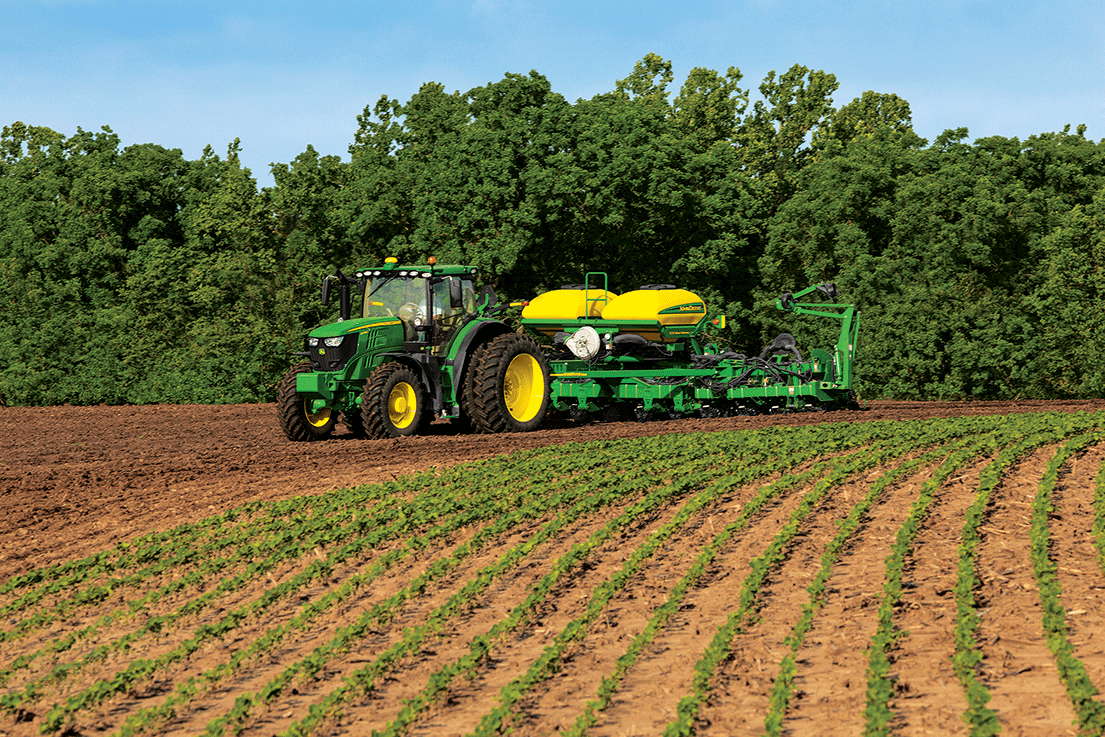

- Grain and Row Crop growers

- Horse Farms & Stables including CCC & Equine Mortality

- Cotton growers

- Citrus growers

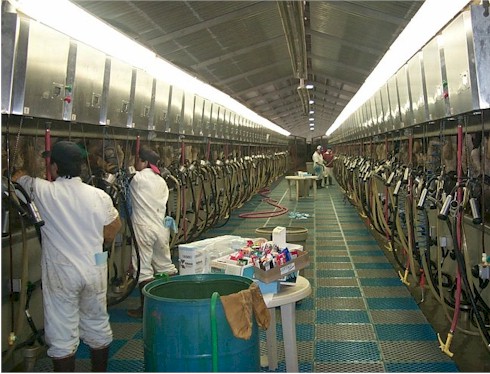

- Dairy Farms

- Hobby Farms

- Estate Farms

- Nut Orchards & Berry Growers

- Vegetable Growers & Packers

- Vineyards

- Wholesale nurseries

- Cotton Gins

- Dairy Operations

- Farm Products

- Farm Supply Stores

- Feed Manufacturing

- Feed Yards

- Feed, Hay and Grain Dealers

- Flour Milling

- Food Processing

- Fish Processing & Farms

- Fish or Seafood Processing

- Produce Packing

- Seed Merchant

- Winery Program

COVERAGE A-- DWELLING

| Replacement Cost Primary dwelling and structures attached to covered dwellings when insured to 80% or more of replacement cost value. |

|

| Inflation Guard Optional on dwelling (including ordinance and law option) |

|

| Satellite Dish/Antenna $1,500 Limit – Higher limit available |

|

| Trees, shrubs and plants within 500 feet of covered dwelling for up to $2,000. |

COVERAGE B -- OTHER PRIVATE STRUCTURES

| Limit 20% of dwelling limit for unattached structures appurtenant to the dwelling not used for farming purposes. No distance limitation. Higher limits available for charge. |

COVERAGE C -- HOUSEHOLD PERSONAL PROPERTY

| Limit 50% of dwelling limit is standard. Higher limits available. |

|

| Property off premises $1,000 worldwide |

|

| Special Limits $2,000 for grave markers $3,000 for securities and letters of credit $3,000 for furs, jewelry, precious stones and watches $5,000 for firearms $ 400 money, gold, platinum, silverware $3,000 for watercraft, outboard engines, watercraft furnishings and trailers $5,000 business property on premises, 10% off premises $5,000 for silverware or goldware. |

|

| Replacement Cost For nominal charge, Coverage C Limit automatically increased to 70% of dwelling limit. |

|

| Refrigerated Products $500 for refrigerated household contents. No deductible |

|

| Credit Card $500 for credit card and fund transfer card forgery and counterfeit money. |

COVERAGE D -- ADDITIONAL LIVING EXPENSES

| Coverage for necessary increases in living expense if a covered cause of loss renders your home uninhabitable. 10% of dwelling limit |

COVERAGE E — SCHEDULED FARM PERSONAL PROPERTY

| Newly Acquired Or Replacement Farm Machinery: $100,000 for up to 30 days |

|

| Personal Property of Other: $2,500 |

|

| Tack & Related Equipment: No sub-limit for unscheduled items |

|

| Replacement Cost : Available for office contents and tack |

|

| Transportation: $2,000 included |

|

| Farm Records: $2.000 for restoration. No deductible |

|

| Extra Expense: $2,000 included. No deductible |

|

| Livestock: Up to $2,000 per animal available |

|

| Peak Season: Available for seasonal fluctuations |

COVERAGE F — BLANKET OR UNSCHEDULED PERSONAL PROPERTY

| Unscheduled farm machinery and equipment | |

| Farm products in the open for certain causes of loss | |

| Property in the custody of a common contract carrier $1,000 Limit |

|

| Cost of restoring farm records $2,000 Limit |

COVERAGE G — OTHER FARM STRUCTURES

| Replacement Cost: Available when insured to 80% of Replacement Cost. If not insured to 80%, Actual Cash Value applies. |

|

| New Construction: Automatic $250,000 coverage for 60 days. |

|

| Private Power and Light Poles | |

| Outdoor Radio & TV equipment, antennas and towers | |

| Fences, corrals, pens, chutes and feed racks | |

| Silos, portable buildings and structures | |

| Improvements and betterments | |

| Loss of Income: Available for covered perils |

|

| Blanket Coverage: Available for farm buildings other than dwellings |

OPTIONAL COVERAGE

| Disruption of Farming Operations | |

| Earthquake | |

| Equine Professional Services Endorsement | |

| Identity Theft Protection | |

| Farm Computer Coverage | |

| High Value Dwelling Endorsement | |

| Trainers Professional Liability | |

| Livestock Breeders Endorsement | |

| Livestock Collision Endorsement | |

| Beekeepers Endorsement | |

| Watercraft Hull Coverage | |

| Agricultural machinery rental reimbursement | |

| Extra Expense and Business Income Coverage | |

| Transportation Coverage increased limits | |

| Enhanced Pollutant Cleanup Endorsement | |

| Sump overflow and water backup from sewers and drains |

Identity Theft Protection

You can add identity theft protection program to an Allianz homeowners, farm owners, condo or renters policy. If you become a victim of identity theft, this program provides you with access to a consumer fraud specialist, who can guide you through the process of reclaiming your identity, including:

- Obtaining a free credit report from the three major credit reporting agencies

- Placing fraud alerts with all three credit reporting agencies

- Enrolling you in six months of daily credit monitoring

- Completing dispute letters on your behalf for approval and signature.

This coverage will also reimburse you up to $25,000, with no deductible, for the expenses associated with clearing your name and repairing your damaged credit, such as:

- Lost wages (up to $1,000 a week for a maximum of 5 weeks)

- Reasonable attorney fees incurred, with ACE prior approval

- Daycare and eldercare expenses

- Notary and certified mailing charges

- Loan re-application fees, and

- Long distance phone charges.

Orchard & Vineyard Endorsement

|

|

|

Dairy Endorsement

|

|

|

Equine Property Endorsement

|

|

|

Tack Equipment Endorsement

|

|

|

High Value Dwelling Endorsement

|

|

|

COMPREHENSIVE PERSONAL & COMMERCIAL GENERAL LIABILITY

Limits

| Occurrence | $300,000 – $1,000,000 |

| General Aggregate | $600,000 – $2,000,000 |

| Aggregate Products/Completed Operations | $600,000 – $2,000,000 |

| Personal / Advertising Injury | $300,000 – $ 1,000,000 |

| Chemical Drift Aggregate | $25,000 – $500,000 |

| Medical | $5,000 |

| Fire Legal Liability | $100,000 |

| Excess Umbrella Liability | $5,000,000 |

Newly acquired or leased premises

| Newly acquired or leased premises: Automatically covered during policy term. Must be added at renewal to be covered. |

|

| Broad Form Contractual: Included |

|

| Custom Farming: Included when receipts less than $10,000 |

|

| Pollutant Cleanup $10,000 including debris removal (can be increased) |

|

| Automobile: Optional |

|

| Personal Injury: False arrest, slander, wrongful entry and eviction covered |

|

| Advertising: Included |

|

| Incidental Business Pursuits: Available subject to underwriting guidelines for charge |

|

| Catastrophe Liability: Excess liability available with limits $1,000,000 to $25,000,000 |

|

| Care, Custody & Control Optional coverage for horse of others under your control with limits $5,000 to $250,000 |

INELIGIBLE RISKS

| Farms principally engaged in commercial operations other than farming or ranching | |

| Dude Ranches, all resorts, religious retreats and camps | |

| Outfitters or Guide services | |

| Vacant farms or ranches | |

| Nursery operations – Retail | |

| Poultry hatcheries |

Flexible Billing

We offer several billing options to make it easier on your budget.

Claims Service

24 hours, 7 days a week toll-free Claim Action Hotline puts you in immediate contact with a claim service representative, enabling you to report claims quickly and efficiently. Prompt reporting helps mitigate the risk of injury or damage and expedites claim handling.

Why brokers and their clients choose Allianz for Farm & Ranch

• From basic coverage to custom solutions –

Farm & Ranch Basic provides essential coverages while our Multiguard program is one of the broadest farm packages available.

• A strong history in Farm & Ranch – Allianz affiliates have served the insurance needs of American farms and ranches since 1876.

• Highly-qualified Risk Services Professionals – Our specially-trained consultants can help your clients take proactive measures to protect their farms, ranches and even wineries.

• Local knowledge, global reach – Allianz’s global network keeps service close to the customer and provides access to professionals who know the local territory, culture, language and regulations in close to 200 countries and territories.

• Specialized claims support – Claims are handled by adjustors and surveyors with years of hands-on agribusiness experience.

• Market leading capacity – Allianz has the capacity and financial strength to handle the largest risks.

• Long-term relationships – Dedicated client teams are committed to superior service, transparency

and flexibility.

About Allianz

As an international financial services company, we offer our 85 million customers worldwide products and solutions in insurance and asset management. Allianz Global Corporate & Specialty is our dedicated brand for corporate, specialty, and middle market risks and insures over half of the Fortune 500® companies.

Customizable Coverage to Protect Agricultural Enterprises

Farm and Ranch Multiguard® (PDF Information)

Our Multiguard solution goes beyond basic insurance by covering more risks and providing higher limits. With Allianz

coverage options, your client can customize their policy to fit the way they live and do business.

Multiguard Farm & Ranch

Our Multiguard package covers:

Property

• Automatic inflation protection for residential or

farm building construction costs

• Outdoor antennas and satellite dishes – $5,000

• Money, gold, silver – $2,000

• Watercraft – $5,000

• Household personal property within a vault – $50,000

• Newly acquired and replacement equipment –

$500,000

• Borrowed farm equipment, including leased/rented –

$50,000 (or $100,000, depending upon the state)

• New construction – $250,000

• Extra expense for machinery breakdown – $5,000

• Pollutant cleanup and removal expense – $10,000,

with the option to increase to $50,000 or $100,000

Liability

• Medical payments – $5,000

• Fire damage liability – $100,000

• Chemical drift: physical injury to crops,

animals – $100,000

• Damage to property of others – $1,000

• Owned watercraft less than 50 horsepower

and non-owned watercraft

• Incidental custom farming – annual receipts

up to $15,000